Distribution of the Circulating Supply of Bitcoin

Bitcoins are not infinite.

There is an upper limit, set at 21 million pieces.

Currently, the circulating supply corresponds to about 18.650 million. But how are these Bitcoins distributed? Who holds the most of them?

Bitcoin: Analysis of the Circulating Supply

In a Bloomberg article, it was stated that about 2% of entities own 95% of the existing bitcoins.

This statement is inaccurate as it is assumed that those 2% correspond to individuals.

In reality, each entity could encompass a multitude of individuals.

In essence, it is not certain that if there are 1000 bitcoins in an address, all of them belong to a single individual. It's possible that that abundance of bitcoins is owned by a multitude of individuals, who perhaps prefer to entrust their cryptocurrencies to a single entity.

Journalist Rafael Schultze-Kraft, in a study for Glassnode, a prestigious on-chain analytics site, seeks to shed light on these issues.

Schultze-Kraft divides all bitcoin holders into different entities, comparing them to marine species.

- Shrimps (<1 BTC)

- Crabs (1-10 BTC)

- Octopuses (10-50 BTC)

- Fish (50-100 BTC)

- Dolphins (100-500 BTC)

- Sharks (500-1,000 BTC)

- Whales (1,000-5,000 BTC)

- Humpback whales (>5,000 BTC)

Each marine species is associated with a multitude of entities that hold a defined amount of Bitcoin.

Exchanges and miners are excluded from this subdivision as they own a significant amount of the cryptocurrency par excellence.

According to Glassnode's studies, this is the most precise division.

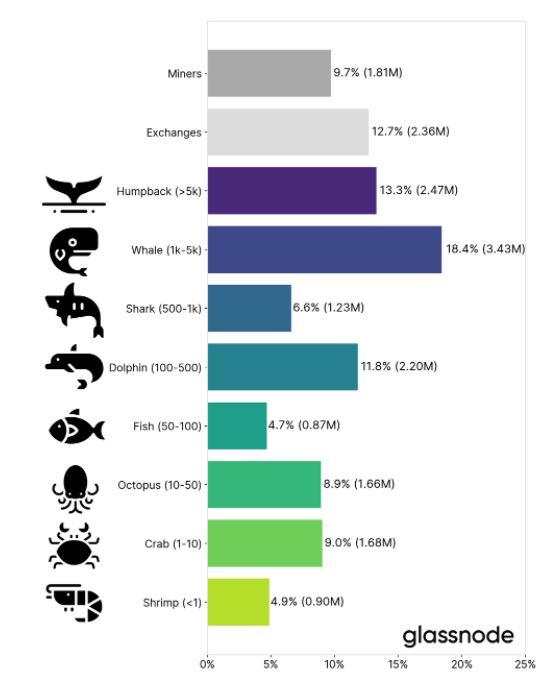

As we can see, Whales and Humpback whales own a total of 5.9 million Bitcoins equivalent to about 31.7% of the circulating supply.

While Shrimps, which correspond to all those entities that own less than 1 Bitcoin, represent a small slice of all entities, with only 0.9 million bitcoins, or less than 5% of the entire circulating supply.

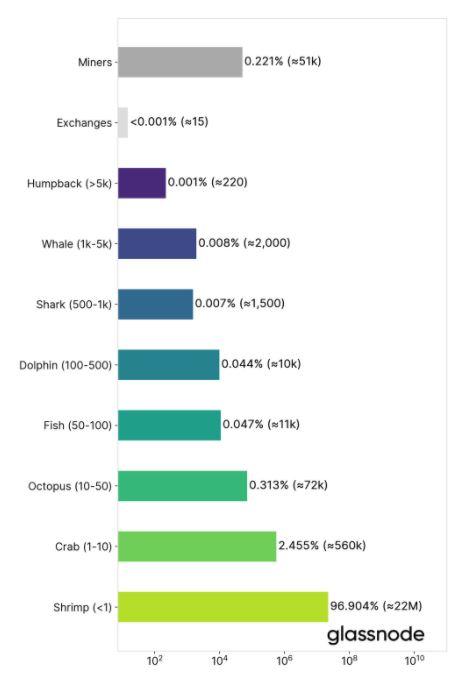

Let's now go on to analyze the number of participants encapsulated in each individual entity.

Whales and Humpback whales, as expected, encapsulate few participants within them, while Shrimps, Crabs, and Octopuses represent the majority.

These data show how so many participants, mostly retail or amateurs, own few Bitcoins, while a few institutional participants own a large slice of all bitcoins in circulation.

Is Centralization of Circulating Supply a Problem?

A centralization of the circulating supply would certainly be a problem.

The more the total amount is held in the hands of a few individuals, the more there is a risk of manipulation.

Let me remind you that Blockchain technology, or the network on which Bitcoins run, is founded on the essence of decentralization.

Bitcoins themselves were created with the goal of providing anyone with financial independence from centralized entities.

So seeing many millions of bitcoins enclosed under the wing of a few entities certainly clashes with the underlying philosophy.

It is evident a partial centralization of the distribution of all existing Bitcoins, channeled into the hands of whales and humpbacks, exchanges and miners.

There is a need to consider, however, that:

- Humpbacks and Whales represent predominantly institutional investors, who, most of the time, manage funds of a multitude of investors.

Taking this exception into account, the centralization of supply is less pronounced than it seems. - Exchanges must have a "Bitcoin stash" on their balance sheet, in case many individuals want to buy Bitcoin, and few want to sell. So the crypto balance of exchanges is calculated according to the demand for Bitcoin in the market.

- As for the miners, the amount held by these entities is justified by the fact that they are the engine of all bitcoin transactions.

If there were no miners, there would be no Bitcoin!

Although a centralization of the circulating supply is evident, these figures are not alarming.

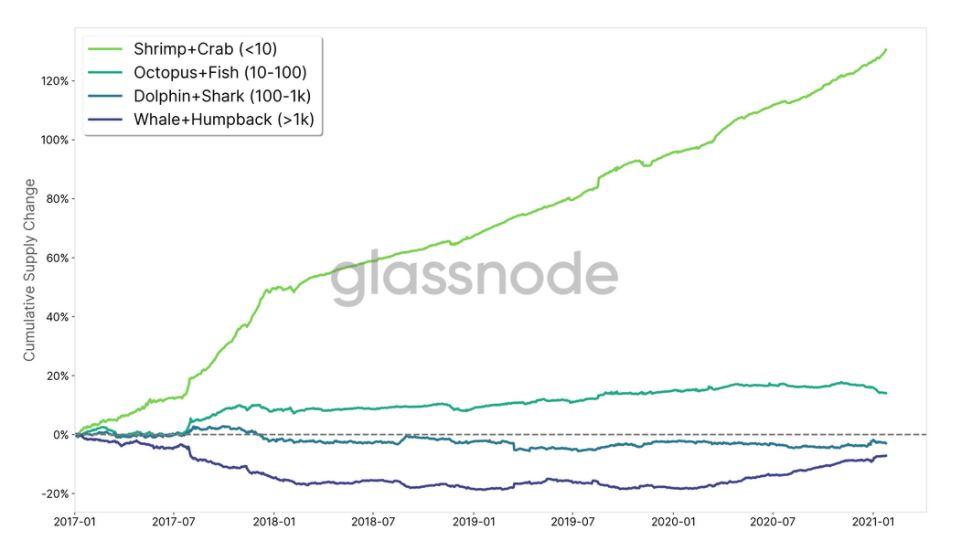

Looking at this last graph we notice that, since 2017 the overall shrimp and crab balance is increasing greatly, while the large Bitcoin holders are ceding a significant slice of the pie to the market.

This data is reassuring and averts a danger of supply centralization.

It will be important to monitor the evolution of these numbers over time and intervene early if we encounter any major dangers of centralization.

For now, the situation shows how small investors are quickly pouring into the market, auguring well for increasing decentralization of all circulating Bitcoin.