What is and how does Cryptocurrency Staking Work?

Staking is a process that is applicable to cryptocurrencies and serves several purposes, including:

- ensuring distributed consensus within the blockchain

- rewarding users who decide to stake their digital coins

What does it mean to "Stake" cryptocurrencies?

Proof of Work (POW) and Proof of Stake (POS)

"Proof of Work" and "Proof of Stake" are two protocols used in the world of cryptocurrencies, to obtain distributed consensus through the validation of transactions by some validator nodes. Who are the validator nodes? Validator nodes are those who, through Mining (Proof of Work) or Staking (Proof of Stake), guarantee the survival of the Blockchain ecosystem by validating cryptocurrency transactions. Each cryptocurrency has a POW or POS protocol.

- Mining is an activity that requires the use of hardware and other electronic devices. It is very difficult to mine without having special skills and computational knowledge. If you are interested in learning more about how mining works, you can read our article "Cryptocurrency mining explained simple".

- Staking is an activity that assumes only the possession of certain digital coins. It's very easy to do staking, even if you don't have particular skills and knowledge. If you want to know more about Proof of Work and Proof of Stake you can read our article "Proof of Work VS Proof of Stake: how it works".

In any case, both mechanisms, so both Proof of Work and Proof of Stake, reward validators with a cryptocurrency payout generated automatically through different parameters. Generally speaking, the more computing power(mining) or frozen (crypto) tokens (staking) are made available to the infrastructure by a certain party, the more remuneration there will be for the latter.

How to Stake Cryptocurrencies

There are various platforms that allow you to Stake Crypto. Below we analyze 3 of the most well-known and used Staking Platforms, namely:

A common feature of these 3 platforms is the possibility to withdraw funds at any time, without having to freeze the assets in question for a certain period of time. Before we continue, we would like to clarify that we do NOT have any kind of partnership with the companies and platforms mentioned here and therefore we have NO economic interest in talking about these platforms. Our intent is purely informative and educational. The information in this article is NOT intended in any way as financial advice. That said, let's see the retail platforms...

NEXO

Nexo is a British company that operates in 200 different jurisdictions, with over 40 cryptocurrencies that can be staked, managing assets worth over $4 trillion. More than 1 million users manage their own crypto funds on Nexo. The peculiarities of the platform are as follows:

- the company operates in absolute transparency, possessing all the necessary licenses, and being labeled as a regulated financial institution

- Is insured for over $100 million, providing extra security to its investors

- Has its own native token, namely the cryptocurrency "NEXO"

Users can then decide to get the proceeds of staking in 2 ways:

- by receiving payments with the same currency they have "lent" (what they have staked)

- receiving payments through the NEXO token

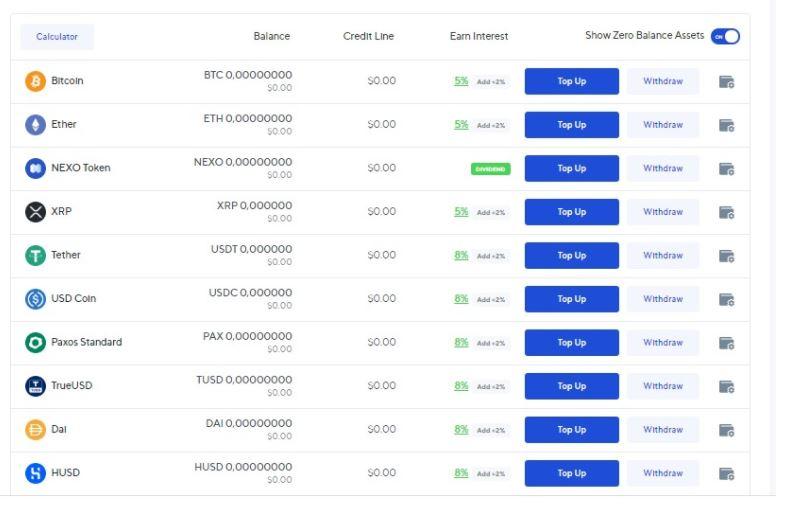

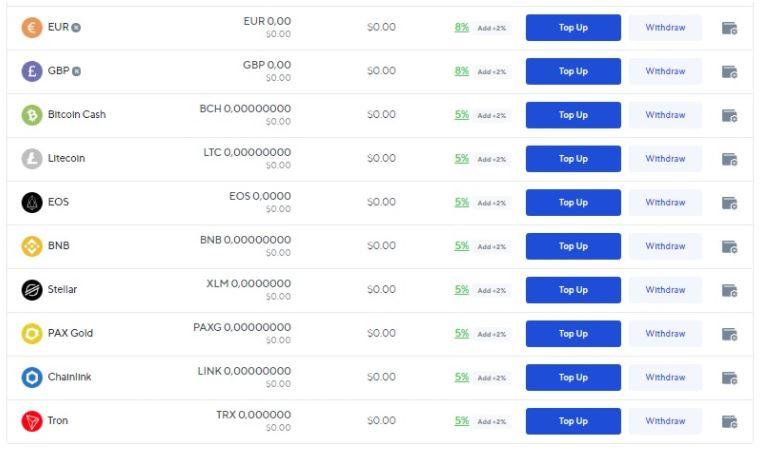

The Value of the NEXO Token grew by 700% between 2020 and 2021, as the chart below indicates:  The rewards are paid daily and you can withdraw your funds at any time, enjoying the interest accrued. In addition to cryptocurrencies, it is possible to "freeze" your FIAT assets, that is to say, it is also possible to staking euros. What are the interests recognized by Nexo to its users?

The rewards are paid daily and you can withdraw your funds at any time, enjoying the interest accrued. In addition to cryptocurrencies, it is possible to "freeze" your FIAT assets, that is to say, it is also possible to staking euros. What are the interests recognized by Nexo to its users?

You can eventually receive an additional 2% annualized by choosing to be remunerated with the NEXO Token. If instead you decide to deposit your NEXO token you are entitled to enjoy an Annual Dividend that corresponds to 30% of the company's profits, divided and distributed among all NEXO holders. In fact, on August 15, 2020, $6,127,981.39 was recognized to NEXO token holders, equal to 30% of its net income during the period between June 30, 2019 and June 30, 2020.

You can eventually receive an additional 2% annualized by choosing to be remunerated with the NEXO Token. If instead you decide to deposit your NEXO token you are entitled to enjoy an Annual Dividend that corresponds to 30% of the company's profits, divided and distributed among all NEXO holders. In fact, on August 15, 2020, $6,127,981.39 was recognized to NEXO token holders, equal to 30% of its net income during the period between June 30, 2019 and June 30, 2020.

CELSIUS

Just like Nexo, Celsius is also a debit/credit platform that allows its users to generate passive annuities through the deposit of their crypto assets. These are its main features:

- the company is headquartered in the UK and the US, and enjoys a decent reputation and reliability

- it has its own native token called CEL (Celsius), which however, unlike the NEXO token, does not distribute dividends to its holders

- Makes available to its investors an insurance up to 100 million dollars.

CEL, between 2020 and 2021, was the token that appreciated the most compared to all the other 8 thousand existing cryptocurrencies, even supeing his majesty Bitcoin. In fact, from January 25, 2020 to December 31, 2021, Cel had an increase of 4150% (X41.5). Here is the chart that demonstrates this:  These providers provide not only "earn" (passive income) and "custodial wallet" (management of their private keys) services, but also a "borrow" service, through the collateralization of some assets put up as collateral. Getting a Crypto Loan What drives some users to borrow crypto, by depositing collateral, rather than using the collateral itself as liquidity? There are basically 2 reasons:

These providers provide not only "earn" (passive income) and "custodial wallet" (management of their private keys) services, but also a "borrow" service, through the collateralization of some assets put up as collateral. Getting a Crypto Loan What drives some users to borrow crypto, by depositing collateral, rather than using the collateral itself as liquidity? There are basically 2 reasons:

- the opportunity to enjoy liquidity by keeping their crypto assets, avoiding selling them and losing any future gains

- the tax advantage in the request for a loan, which does not generate capital gains, as in the case of the sale of its assets

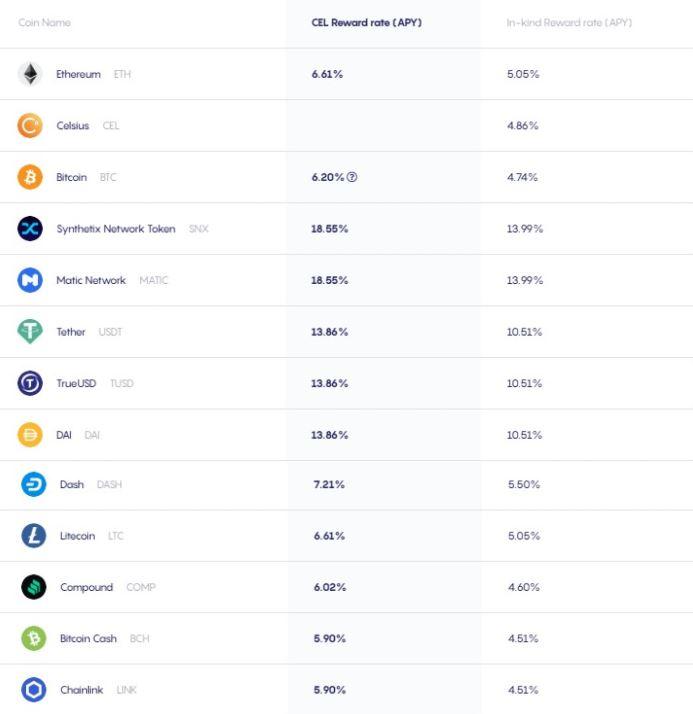

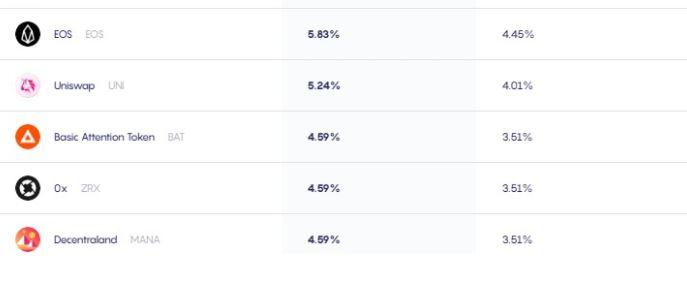

Let's see now the returns recognized in the most used service, that of "earn on your crypto". Below

Just as in the case of Nexo, there are no obligations to freeze your funds, so you can withdraw your tokens at any time and the interest is paid weekly. In the first column of the table (the one colored in blue) you can see the percentage recognized in case you choose to receive interest through payment in CEL tokens. If instead you prefer to receive interest in the same token deposited (e.g. Bitcoin deposit and receive interest in Bitcoin), the column of reference is the second (the one in white). Note that Celsius does NOT support staking for FIAT currencies, so it is not possible to deposit and accrue euros.

Just as in the case of Nexo, there are no obligations to freeze your funds, so you can withdraw your tokens at any time and the interest is paid weekly. In the first column of the table (the one colored in blue) you can see the percentage recognized in case you choose to receive interest through payment in CEL tokens. If instead you prefer to receive interest in the same token deposited (e.g. Bitcoin deposit and receive interest in Bitcoin), the column of reference is the second (the one in white). Note that Celsius does NOT support staking for FIAT currencies, so it is not possible to deposit and accrue euros.

BLOCKFI

Blockfi is a platform similar to those already described, but it stands out from its competitors for its higher interest rates (especially on bitcoin: 6% per year) and for its cyber security, which is a cornerstone of the company's vision. Unlike Nexo and Celsius, Blockfi does not have its own native token, but is a platform born thanks to large investments from several institutional entities, including Coinbase. It relies on an American exchange called Gemini (regulated by the "New York departments financial services"), which provides an insurance of 200 million dollars on cold wallet, or offline wallets. Gemini blokchain keeps 95% of users' funds in the cold wallet, providing an additional measure of security, avoiding hacker attacks from online use. The remaining 5% is kept in the hot wallets (online) and has a second insurance to be able to operate in total peace of mind. In addition Gemini is the only exchange to have obtained the SOC2 certification, which represents a transversal recognition by the company Deloitte, based on 5 fundamental points:

- Security

- Privacy

- Integrity

- Confidentiality

- Service availability

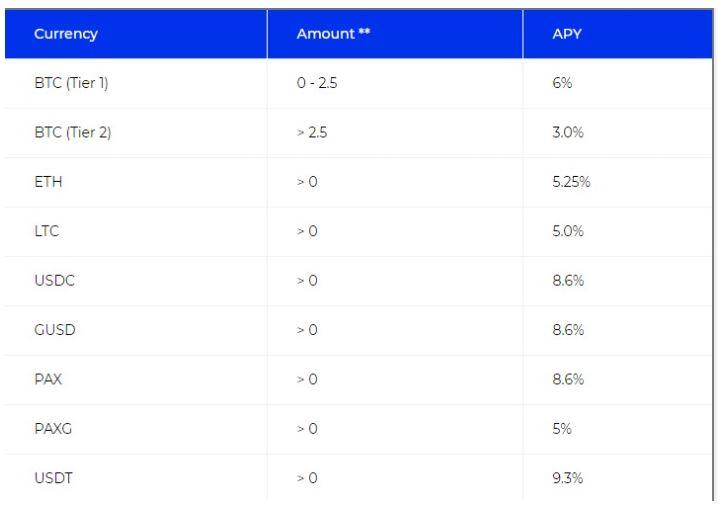

Interest is accrued daily, but credited once a month, with the percentages shown in the following table:  A distinctive feature of Blockfi is the ability to receive interest in any of the cryptos supported by the system regardless of which cryptocurrency you deposited: for example, you can deposit Ethereum and receive interest in Bitcoin, or vice versa. On the third column (APY), you can check the annual interest recognized for each asset deposited. As for Bitcoin, up to 2.5 BTC, the interest is 6%. If you want to deposit more than 2.5 BTC then the interest drops to 3%.

A distinctive feature of Blockfi is the ability to receive interest in any of the cryptos supported by the system regardless of which cryptocurrency you deposited: for example, you can deposit Ethereum and receive interest in Bitcoin, or vice versa. On the third column (APY), you can check the annual interest recognized for each asset deposited. As for Bitcoin, up to 2.5 BTC, the interest is 6%. If you want to deposit more than 2.5 BTC then the interest drops to 3%.

Is it possible to Stake Bitcoins?

Bitcoin started, and still is, as a cryptocurrency based on Proof of Work, i.e. Mining. This means that transactions made in bitcoin are approved, controlled and added to the blockchain (to the Blockchain), through the computing power of the different miners distributed around the world. Staking, therefore, is NOT designed as a protocol through which to freeze bitcoin in order to get a reward. However, there are several Crypto Lending Platforms that allow their users to put in safe for a certain period of time (usually from 3 to 12 months) their tokens (including Bitcoin), to obtain in exchange a passive income, income recognized not through the POS protocol, but through the recognition, by the platform managers, of interest on the funds of customers that are blocked. CONCLUSIONS Staking is an opportunity to generate passive annuities easily and independently. Of course, it also has risks. The risk arising from Staking depends on 2 factors:

- the high fluctuation of deposited cryptocurrency prices

- the exclusive delegation of one's funds to third parties who undertake to guard the private keys of the users

However, Staking represents a solution for those who want to earn compound interest without having to waste energy and engage in trading activities, which we remember to be highly deleterious for non-professionals.